Stories Of Impact

Home Donors Stories Of Impact Following His Calling In Planned Giving

Following His Calling In Planned Giving

This article first appeared on CFS’s Legacy Giving Website. To find out more about Legacy Giving, please click here.

As a trainer at the Insurance and Financial Practitioners Association of Singapore (IFPAS), I found my calling in the field of estate planning and planned giving. Giving is a good intention; planning is a wise action; and planned giving ensures you can leave a legacy and take care of your loved ones.

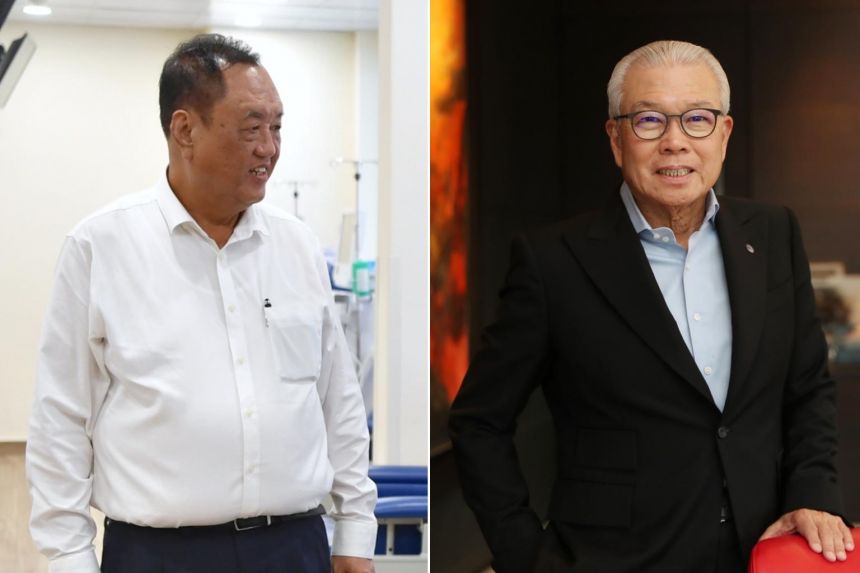

Do you need to wait until you are wealthy to start giving? For Allen Lim, the answer is an emphatic no, but with one distinct caveat. “It’s very important that giving takes into account your and your family’s financial security,” insists Allen, “That’s why planning is crucial, because with the right strategy, you can do both.”

Though Allen says his father’s ways never threatened his family’s security, he also saw how his actions sparked disputes with his mother. That’s why as a financial professional today, Allen advocates taking the middle way.

Having found his “calling” as a trainer in planned giving, he is enthusiastic about raising awareness on this area of practice amongst financial advisors. His days as the Head of Training and Education at the Insurance and Financial Practitioners Association of Singapore (IFPAS) include everything from curating courses on planned giving to lecturing on the latest methodologies.

“Many financial advisors today stop at estate planning. Planning giving goes one step ahead,” reveals Allen, “Through holistic financial planning, a professional can help ensure that giving does not compromise the financial security of the family, while also strategising the most effective asset to complete the giving intention with the best possible outcome.”

And with Singapore’s changing demographics – from a greater number of singles to couples without children – more wealth is being directed outside of one’s family. Allen says financial advisors need to keep up with these trends and engage in these changing conversations.

“Planned giving is an important part of the equation,” he says, “Not only does it help deepen your relationships with your clients, helping to grow the number of legacy gifts to benefit our charities could contribute to well-being in our society.”

- Related Topics For You: ADVISOR STORIES, COLLABORATION, LEGACY GIVING

Trending Stories

Karim Family Foundation: Donor-Advised Fund Raises $200,000 to Support Local Sports Champion Loh Kean Yew

Karim Family Foundation: Donor-Advised Fund Raises $200,000 to Support Local Sports Champion Loh Kean Yew

In December 2021, 24-year-old Loh Kean Yew became the first Singaporean to win the Badminton...

‘I thought I couldn’t go through any more of it’: Cancer patient gets help after insurer says ‘no’ to $33k bill

‘I thought I couldn’t go through any more of it’: Cancer patient gets help after insurer says ‘no’ to $33k bill

Good Samaritans have stepped forward to help a cancer patient, who hopes to spend more...